Table of Contents

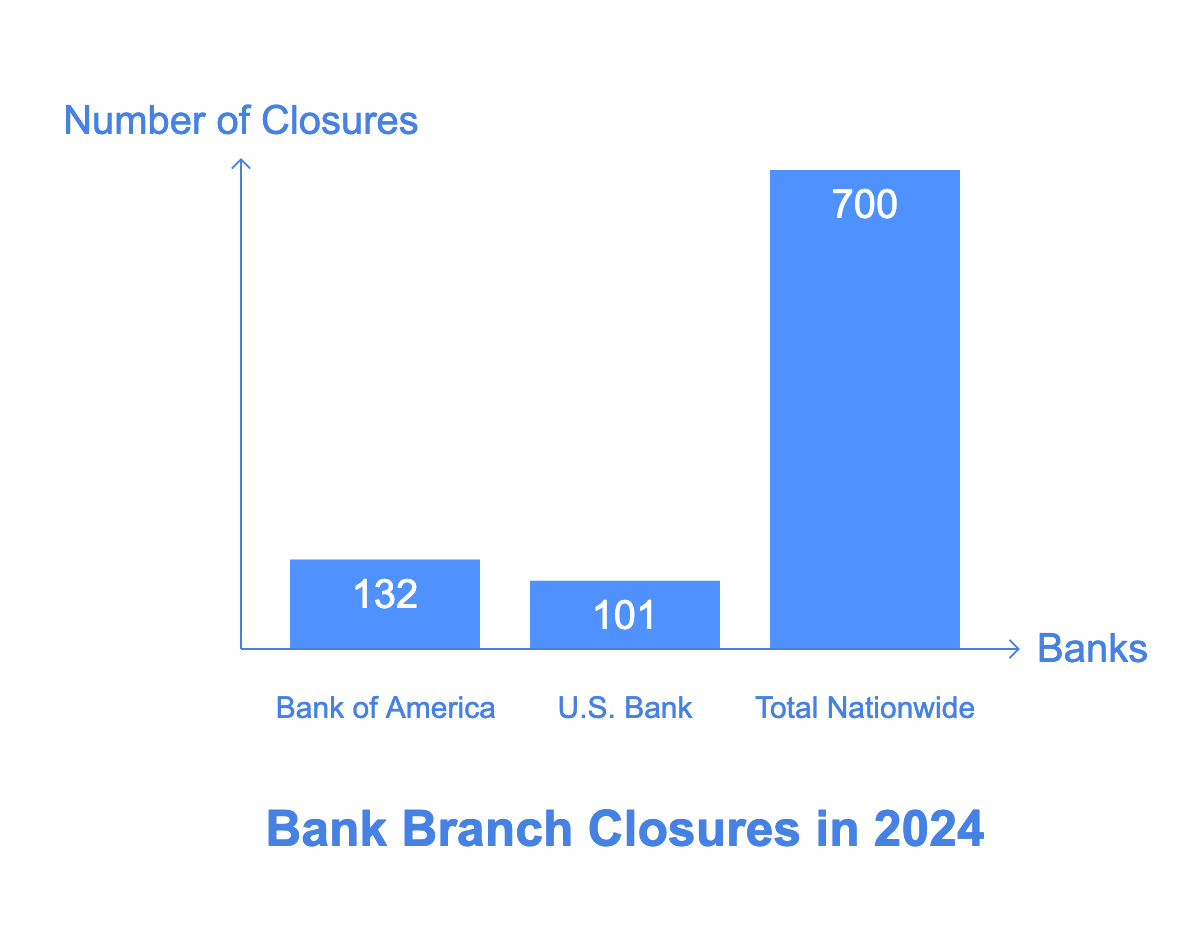

The U.S. banking industry is going through a period of rapid transformation. Over 700 bank branches have shut down this year, and the trend doesn’t seem to be slowing. With Bank of America alone closing 132 locations between January and September, many people are wondering—why is this happening, and how does it impact regular customers and communities?

Below, we’ll break it all down for you, from the reasons behind the closures to their real-world impact and, most importantly, practical ways you can adapt.

Data from the Office of the Comptroller of the Currency (OCC) paints a clear picture of this trend. Here's a snapshot of the top banks closing branches in 2024:

It’s evident that this isn’t a localized issue—it’s a sweeping shift that’s changing the way Americans interact with their banks.

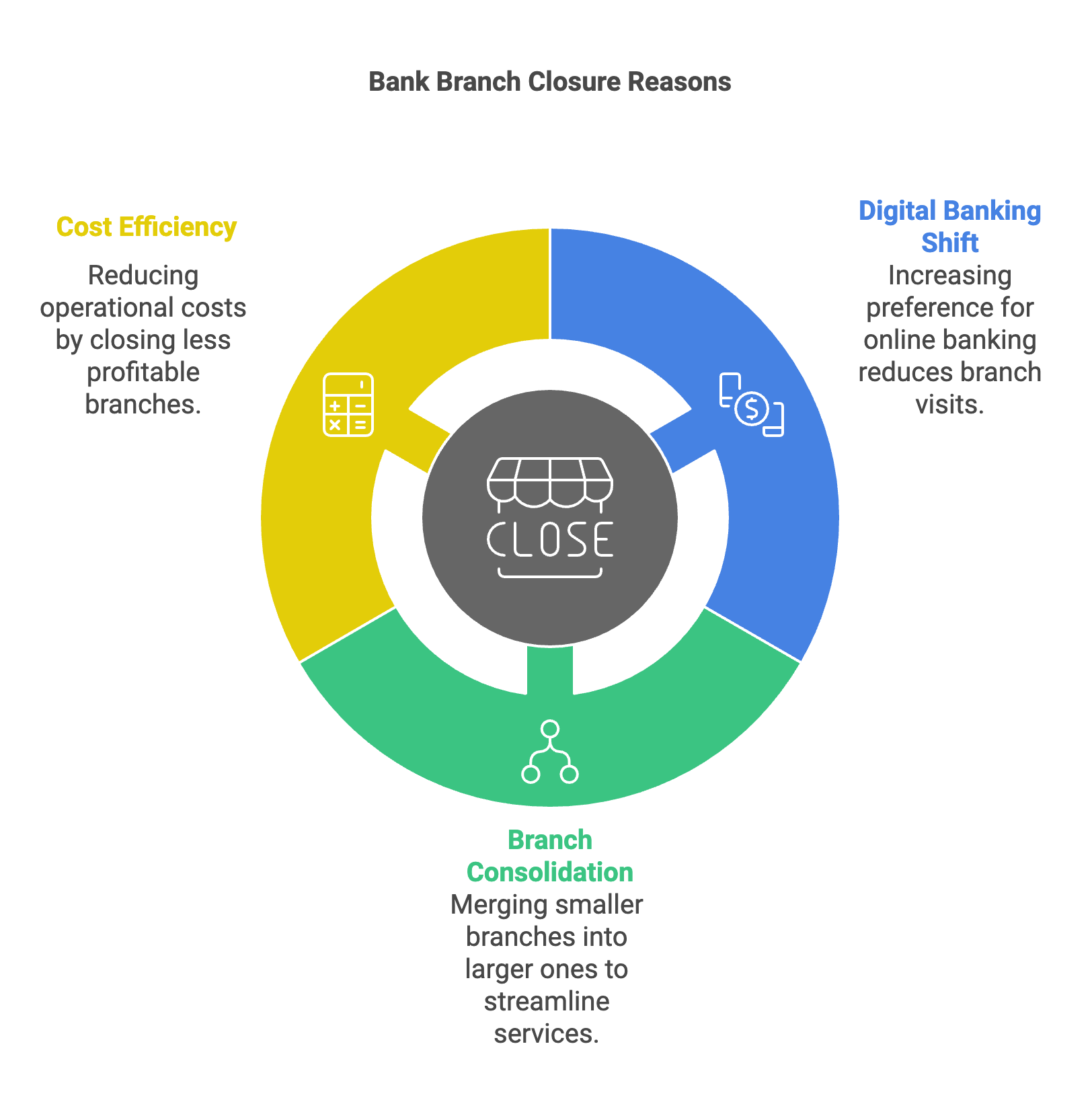

Several factors are driving this wave of bank branch closures. Here’s why it’s happening:

More and more people are choosing online and mobile banking over visiting physical branches. According to recent research:

This shift reduces the demand for brick-and-mortar locations, leading banks to focus their resources on their digital platforms.

Some closures aren’t about eliminating services but streamlining them. For instance, Bank of America has cited “branch consolidation” as a key reason, where smaller branches are combined into larger, more central locations to cut costs while maintaining customer access.

Keeping physical branches running is expensive. From rent to employee salaries and utility bills, the costs add up. By cutting back on branches, banks can invest more in digital customer service, AI capabilities, and other virtual solutions.

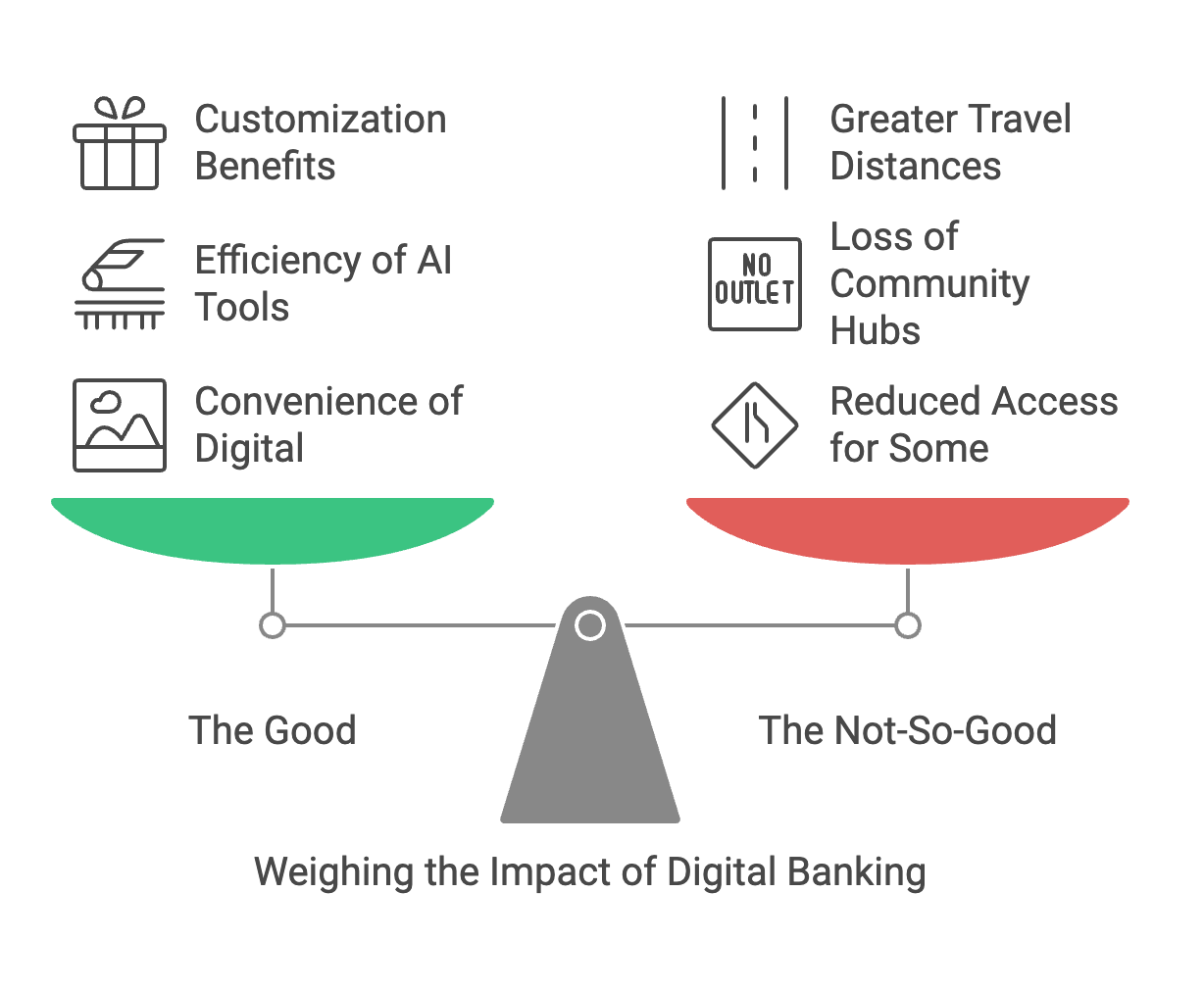

While digital banking offers convenience, the closure of physical branches presents both opportunities and challenges for customers. Here’s a quick breakdown:

Even though these closures are reshaping banking practices, physical branches still play a role. Studies show nearly two-thirds of Americans prefer branches for cash deposits, and many want face-to-face advice for big financial decisions.

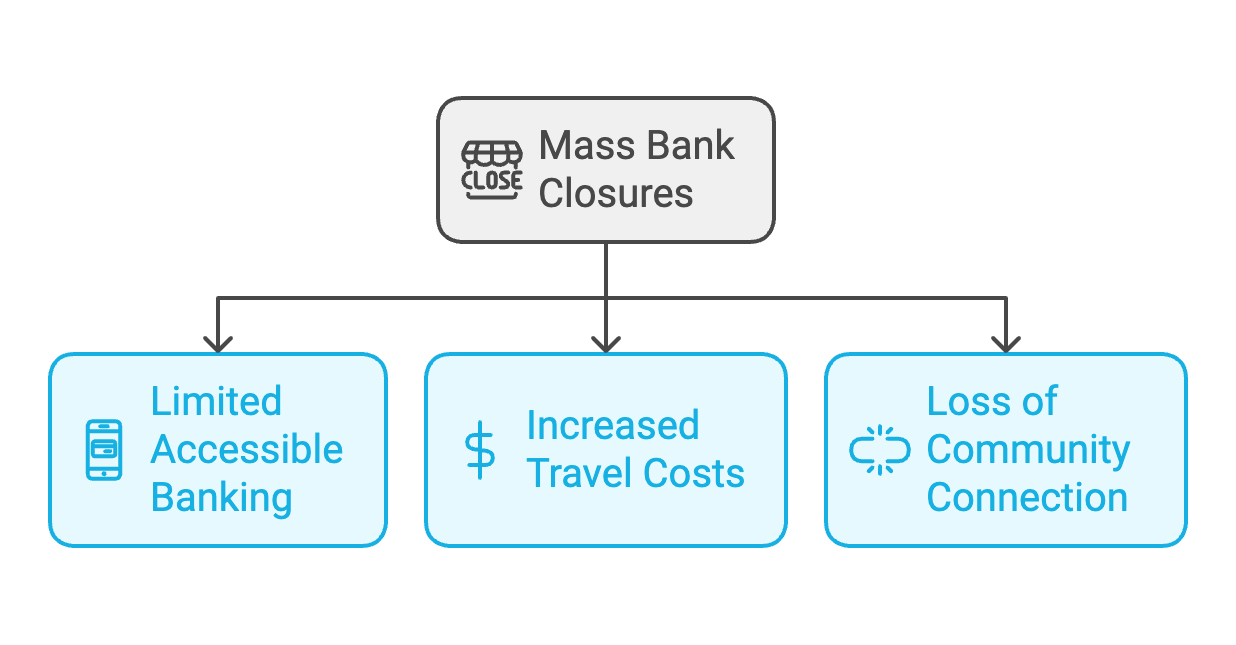

The ripple effects of widespread closures go beyond just switching to an app. Here’s how they could impact you:

Individuals who lack reliable internet access or aren’t comfortable using apps may find it challenging to perform basic tasks like paying bills or applying for loans.

With fewer branches nearby, you may need to travel further to handle tasks that require personal interaction. This can be a hassle, especially for the elderly or disabled.

Community ties to banks play an understated but important role in building trust. A closed branch may leave people feeling disconnected from their financial institutions.

Facing these changes might seem overwhelming, but there are ways to make the most of the evolving banking landscape. Here are some actionable tips:

Take advantage of your bank’s tutorials or help centers to learn how to use their apps or online platforms. Many banks offer user-friendly features, like mobile check deposits and budgeting tools, that can simplify your life.

Enhancing your financial knowledge can empower you to make informed decisions. Look for free resources online or workshops hosted by local organizations to help you build confidence in managing money digitally.

Credit unions, community banks, and fintech apps might offer services that fill the gaps left by big bank closures. For instance, apps like Mint or Chime can help you with budgeting, payments, and even early direct deposits.

Even if you’re not ready to go fully digital, use middle-ground solutions where available—like advanced ATMs for check deposits or phone banking for personalized assistance.

Studies suggest that if the current rate of closures continues, the U.S. could see its last physical branch shut down by 2041. While that might sound far off, it underlines the urgency for banks to evolve.

Institutions that successfully combine traditional banking with digital innovation will likely come out ahead. For example, Bank of America has started opening “financial centers” in select locations while scaling back elsewhere. This balance allows them to maintain physical services where they’re needed most while focusing on their digital strategy.

The closure of bank branches marks the start of a digital-first era in banking. For consumers, this means rethinking how we manage our finances and learning to leverage technology. For communities, it’s a reminder of the importance of preserving access and support for those who rely on in-person services.

The key to navigating this shift lies in adaptability. Whether it’s learning to use digital tools or exploring alternatives, taking proactive steps can make this transition smoother.

How are you adjusting to these changes? Do you prefer the convenience of online banking, or do you miss visiting a branch? Share your thoughts below!