Table of Contents

Warren Buffett has long been revered as the oracle of Omaha, and for good reason. His investment strategy often sets the tone for market trends, influencing everyone from institutional investors to everyday 401(k) contributors. This fall, Buffett's latest moves, revealed in Berkshire Hathaway's quarterly filing, have once again captured the attention of the financial world. But they may also signal caution ahead.

One of Buffett's most unexpected moves is his recent investment in Domino’s Pizza, with Berkshire Hathaway acquiring 1.28 million shares—valued at approximately $549 million by the end of September. This decision led to an immediate 8% spike in Domino’s share price, reaffirming the influence of Buffett’s "seal of approval."

Domino's isn’t just a pizza chain; it has consistently driven innovation in customer experience with initiatives like effective delivery platforms and digital strategies. Buffett's investment speaks volumes of Domino's consistent operational performance and adaptability in a competitive market.

Berkshire also picked up 404,000 shares of Pool Corp., a leading distributor of swimming pool supplies, valued at $152 million. This move reflects Buffett’s keen interest in niche markets that offer stable, long-term returns. Pool Corp’s focus on residential and outdoor leisure markets has made it a winner in the post-pandemic world, where home improvement remains a key trend.

While Berkshire was adding these stocks to its portfolio, it was also making pivotal sell-offs. Shares in longtime Buffett favorites like Apple and Bank of America were reduced significantly, driving speculation about Buffett’s cautious stance on current market conditions.

Perhaps most strikingly, Berkshire has built up cash reserves totaling a record $325 billion—a staggering amount that could buy nearly all but the top 25 companies in the U.S. This stockpiling of cash has analysts buzzing. What could it signify?

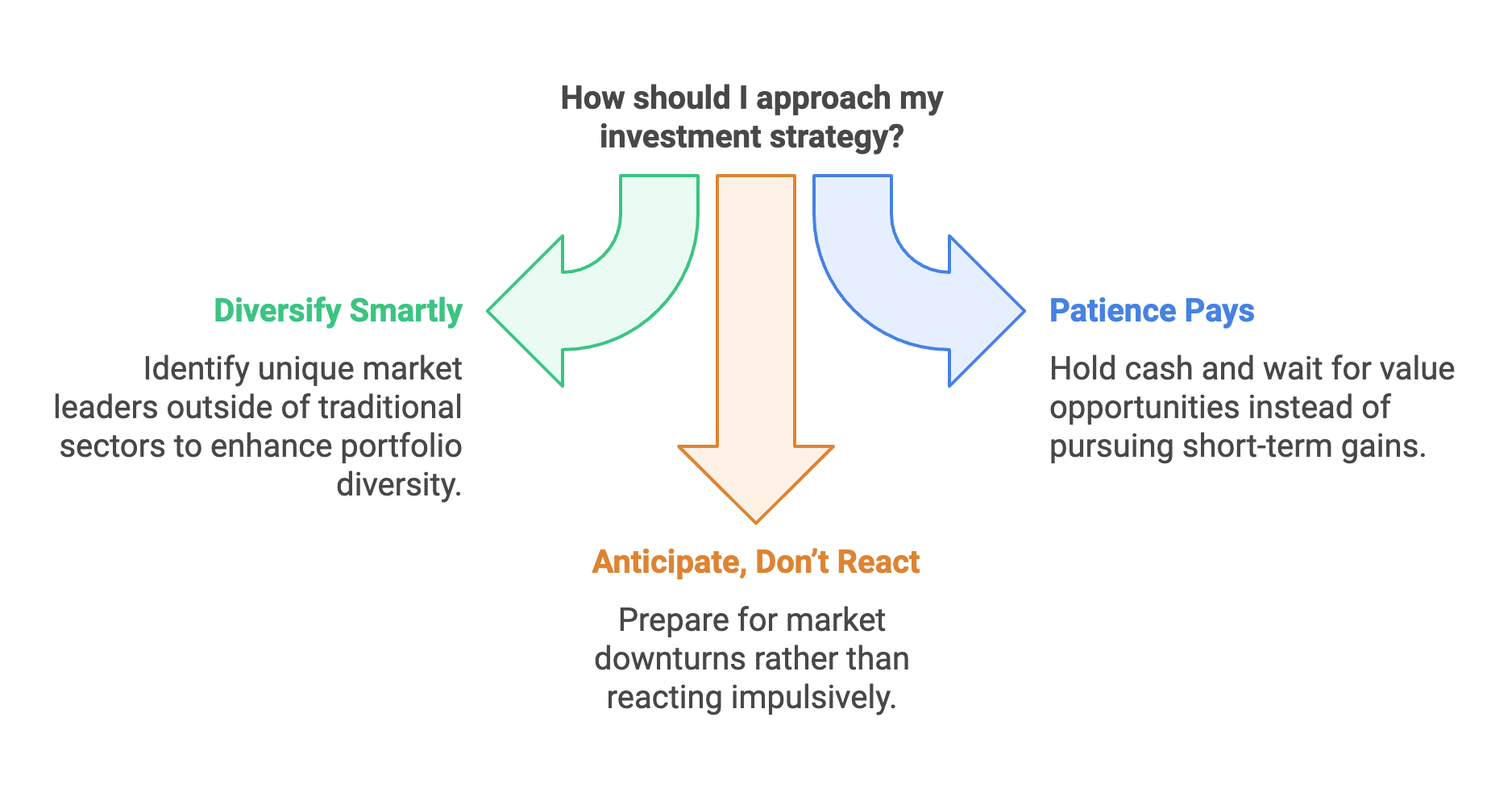

Experts suggest three possible interpretations:

Yet, for someone like Buffett, who famously holds investments "forever," this pivot feels unusually defensive.

When Buffett moves, the markets follow. New stocks often rally as investors take his moves as endorsements of good business prospects, as seen with the rises in Domino's stock. Conversely, sell-offs raise red flags, signaling caution to other investors.

Buffett’s ability to think long term and hedge against market volatility is part of what makes him such a trusted figure in investing. With Wall Street surging on post-election optimism, Buffett's divergence from prevailing market sentiment deserves close attention. Is the rally justified, or should investors brace themselves for a downturn? Only time will tell.

For individual investors, Buffett's moves highlight a few key lessons that are worth noting:

This strategy aligns with his famed quote, “Be fearful when others are greedy, and greedy when others are fearful.”

With $325 billion in cash, Buffett has the capacity to make a game-changing acquisition in the near future. While it’s unlikely he’ll buy giants like Amazon, analysts speculate he could snap up companies like Disney, Pfizer, or AT&T. Such a move would undoubtedly send shockwaves through the market.

One thing is clear—Warren Buffett never makes a move without a plan. Whether it's investing in pizza or pulling away from tech stocks, his decisions provide critical insights for anyone navigating today’s complex economic landscape.

If you're watching the market and wondering where the opportunities lie, don't just react—take a page out of Buffett’s book and think ahead.